Continued Growth Through Acquisitions

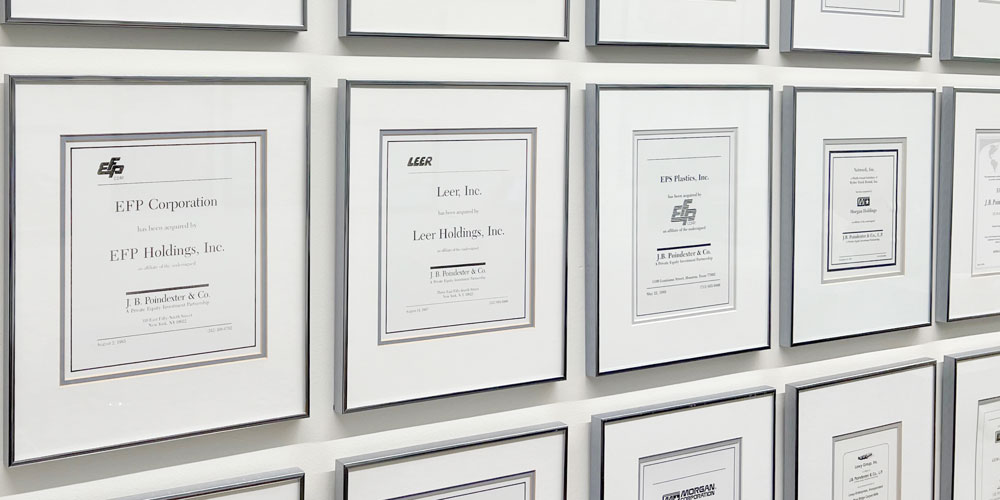

Over the last 30 years, J.B. Poindexter & Co (JBPCO) has completed more than 40 business purchases. Every acquisition is evaluated with a focus on long-term success. We’re committed to continuing our growth through select acquisitions that establish new platforms, expand into additional regions and improve core competencies.

Our Acquisition Process

The continued growth of J.B. Poindexter & Co (JBPCO) is thanks in part to the foundation laid through the enterprise’s acquisition process. When looking at businesses that could potentially be acquired, JBPCO follows a specific business and financial criteria – one that has allowed us to grow considerably over the last 30 years.

Ultimately, JBPCO strives to empower the business that is purchased and build upon what’s been achieved versus pursuing short-term advantages leading to resale.

Driven to Uncover Optimal Opportunities

JBPCO conducts a swift process when looking to acquire companies. Selling companies are to expect:

- A prompt response to inquiries of owners and intermediaries

- Strict confidentiality during and after our review

- Ability to structure transactions to address special situations

- Timely payment of intermediary fees and expenses

- Continued management or advisory roles for selling shareholders, if desired